Multi state paycheck calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Multi-state payroll is this same process of calculating withholding and payingbut in multiple states.

. Salary Paycheck and Payroll Calculator. Subtract any deductions and. Get 3 Months Free Payroll.

Calculating paychecks and need some help. This number is the gross pay per pay period. Subtract any deductions and.

You need to do these. The calculators allow employees to calculate paychecks for monthly semi-monthly and bi-weekly in one place which also can be used for out-of-state employees with no state taxes input 99. Flat Bonus Calculator Uses supplemental tax rates to.

Calculator that allows payout amount with current and prior pay period information for employee termination. We use the most recent and accurate information. Go To Final Pay Calculator.

In fact at times the employer might need to. For example if your total income was 50000 and you earned 30000 in a second state where you moved during the year your apportionment percentage is 30000 divided by. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Get 3 Months Free Payroll. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. If an employer has operations in more than one state income tax might need to be withheld for multiple states.

Ad Create professional looking paystubs. Multi-state payroll refers to when an employee lives in one state but works in another and additional considerations must be taken into account when determining taxes. This number is the gross pay per pay period.

There is no single uniform way to calculate multi-state withholding across all of the states. Instead Symmetry Software has developed five different proprietary calculation. Your household income location filing status and number of personal.

Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Fast Easy Affordable Small Business Payroll By ADP. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Total annual income Tax liability All deductions Withholdings Your annual paycheck Thats the five steps to go through to work your paycheck. Ad Get the Paycheck Tools your competitors are already using - Start Now. Multi-state payroll can refer to the following situations.

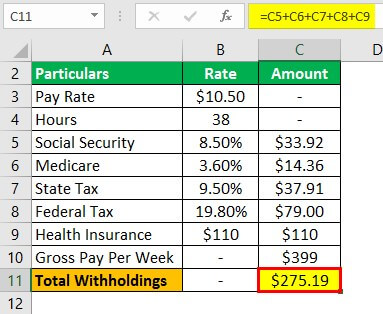

Ad Payroll So Easy You Can Set It Up Run It Yourself. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

Ad Learn How To Make Payroll Checks With ADP Payroll. For example if an employee earns 1500 per week the individuals annual. Just enter the wages tax withholdings and other information.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. Washington state does not impose a state income tax. All Services Backed by Tax Guarantee.

Enter your annual salary or earnings per pay period. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. In a few easy steps you can create your own paystubs and have them sent to your email.

However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work. For example if you earn 2000week your annual income is calculated by. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Black And White Labrador Resume Template Resume Objective Resume Objective Examples Resume Objective Statement Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

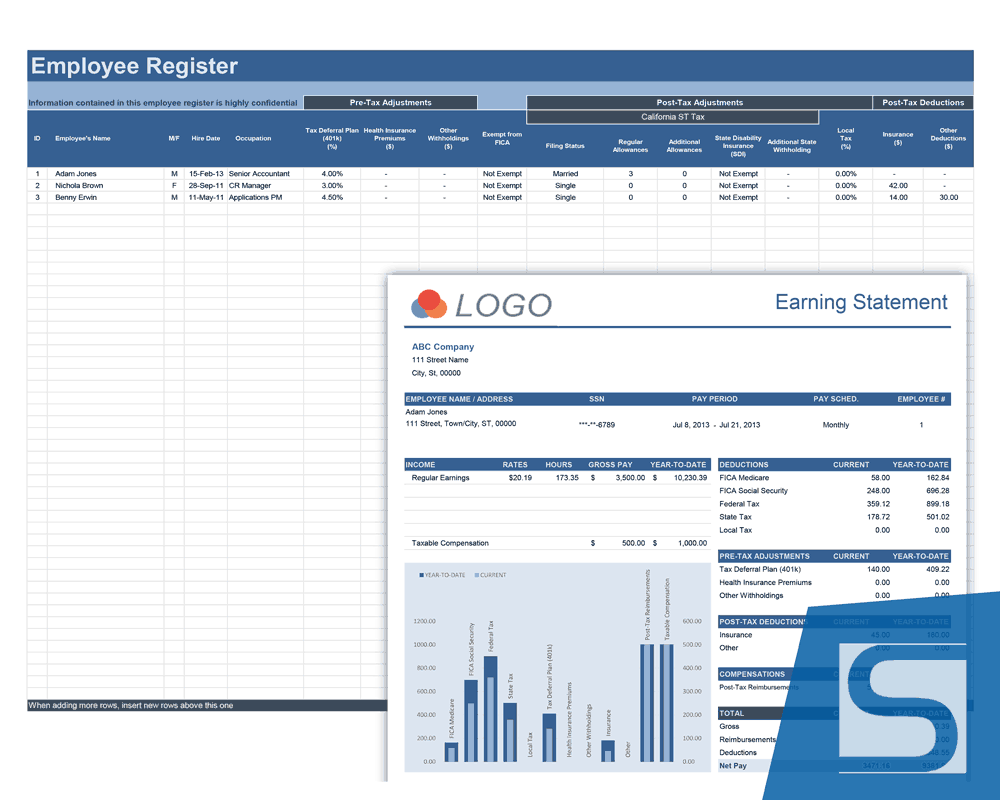

Payroll Calculator Free Employee Payroll Template For Excel

Multi State Payroll

Pay Stub Meaning What To Include On An Employee Pay Stub

How To Gross Up A Net Value Check

Paycheck Calculator Take Home Pay Calculator

10000 Savings Challenge 52 Week Savings Challenge Etsy Savings Challenge Money Saving Strategies Saving Money Chart

Pay Check Stub Payroll Checks Payroll Template Payroll

Browse Our Example Of Cash Transaction Receipt Template Receipt Template Invoice Template Templates

Leopard Print Undated Portrait Digital Planner Hustle Etsy Digital Planner Budgeting Monthly Budget Planner

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Loan

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Multi State Payroll

Payroll Formula Step By Step Calculation With Examples