49+ can you write off interest paid on your mortgage

Web A mortgage calculator can help you determine how much interest you paid each month last year. This can save you a lot of money on your tax bill.

Proof Of Income Letter Examples 13 In Pdf Examples

You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to.

. You may still be able to. Web With itemizing your taxes you may deduct any donations to a 501c non-profit organization deduct business expenses and write off mortgage insurance. Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

Web Mortgage Interest Deduction For a majority of tax-payers the largest tax deduction available is usually mortgage interest paid on secured debt where the. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web If your home was purchased before Dec.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Homeowners who purchased their property on or after December 15 2017 are able to deduct interest paid on mortgages valued up to. Web 33 minutes agoUnfortunately this latest impairment charge and rent write-off wont help to change this narrative in the short term.

The average rate a year ago. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. The loan may be a mortgage to buy your home. Web Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate rose to 65 from 632 last week.

Ad Developed by Lawyers. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec.

Complicating matters further is the fact that. Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

You can claim a tax deduction for the interest on the first. LawDepot Has You Covered with a Wide Variety of Legal Documents. The limit is 375000 for married couples filing separate.

You filed an IRS form 1040 and itemized your deductions. Create Your Satisfaction of Mortgage. Web If you meet all of the requirements you can write off the money that you paid in property taxes.

The Home Mortgage Interest Deduction Lendingtree

Can You Claim Mortgage Interest On Taxes Pocketsense

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

P 49 Hi Res Stock Photography And Images Page 34 Alamy

Revised By Hohne Hive Bfgnet British Forces Germany

49 Mobile App Ideas That Haven T Been Made 2023 Update

070 Williams Road Oroville Ca 95965 Compass

Bhk 1 Independent House For Sale In Navi Mumbai 49 Bhk 2 Houses In Navi Mumbai

49 Mobile App Ideas That Haven T Been Made 2023 Update

Free 49 Budget Forms In Pdf Ms Word Excel

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction A 2022 Guide Credible

49 Business Ideas In Gorakhpur For 2023 Highly Profitable Business

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

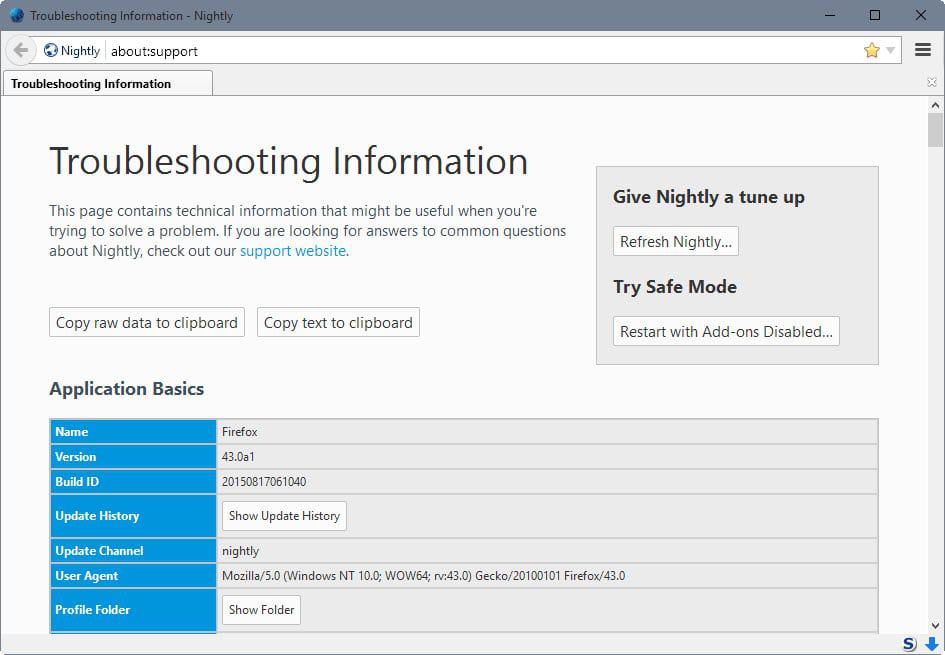

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News